by MLS Vallarta - January 24, 2018

Vallarta/Nayarit Real Estate Market Quarterly Report Q2 2023

by David Moreno - July 25, 2023

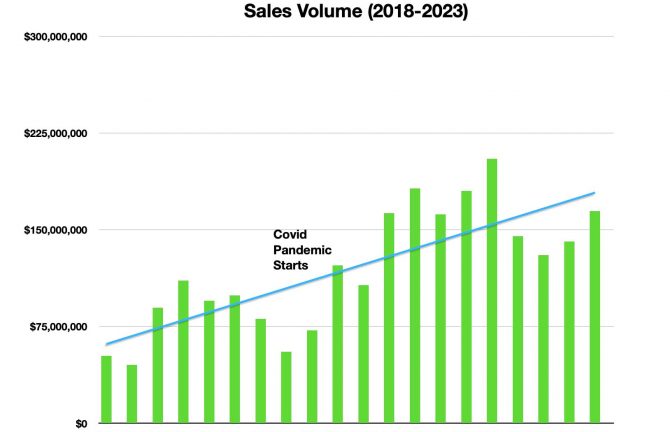

The results for the second quarter of this year shows gross sales for the Puerto Vallarta/Riviera Nayarit region real estate market was up by 14% over the first quarter of this year, marking three straight quarters of gains. Sales volume is now more in line with the historical trend line, as shown in blue below.

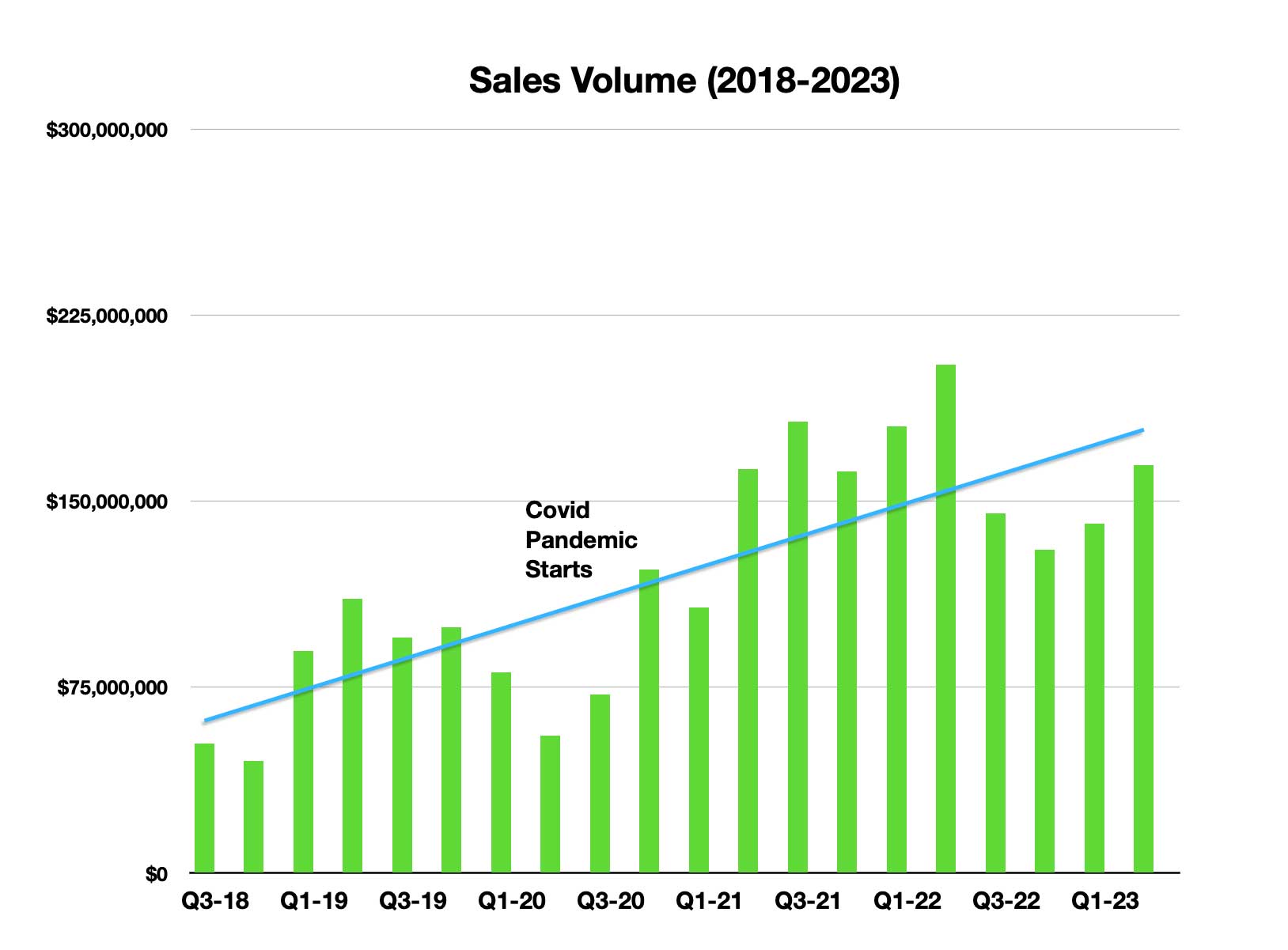

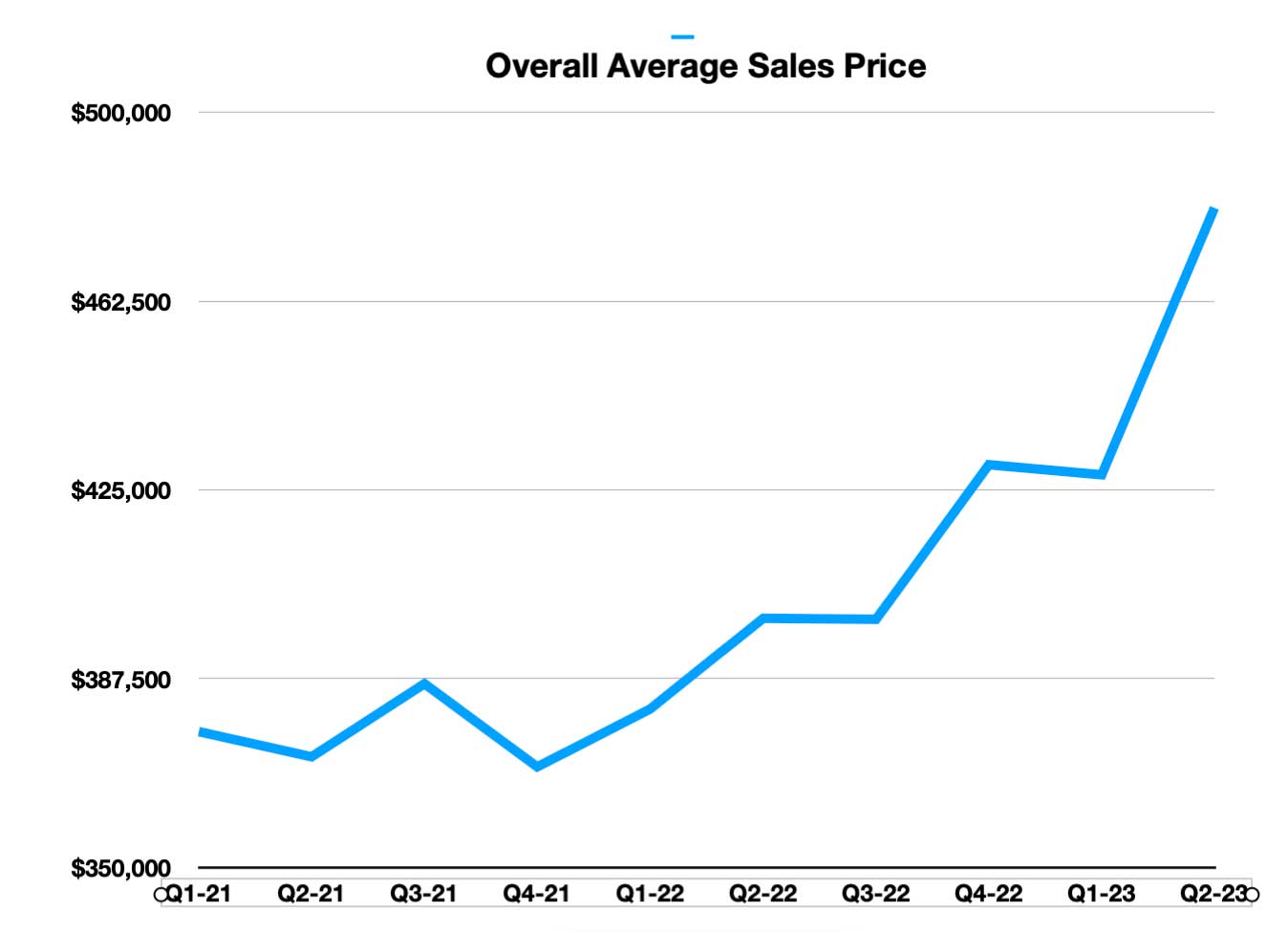

Interestingly, however, that gain was obtained with roughly the same number of sales as the previous quarter, meaning the average price per sale has increased significantly. In the first quarter the average sales price was $420,000 while in the second quarter it was $481,000, more than a 12% increase and posting the highest average sales price recorded to date.

What's this all mean? That the market continues to be very tight with more demand for housing than there is supply. Another marker of a tight market is the difference between the list price and the sales price, which is traditionally between 8-10%. This difference has been steadily shrinking over the past year, showing a 4.5% list-to-sold price ratio for this current quarter. A review of sold prices shows that many are selling for what the property is listed for, and in some cases, for more.

In terms of which regions are the most popular according to number of sales, Nuevo Vallarta and Bucerias in Riviera Nayarit once again, as in the first quarter, took top honors. They were followed by Central Vallarta and the South Shore (between Vallarta and Boca de Tomatlán). The most economical region to purchase (lowest average sales price) continues to be behind the Hotel Zone, in areas such as Versalles, Fluvial and Las Gaviotas that have becoming increasingly more popular with buyers.

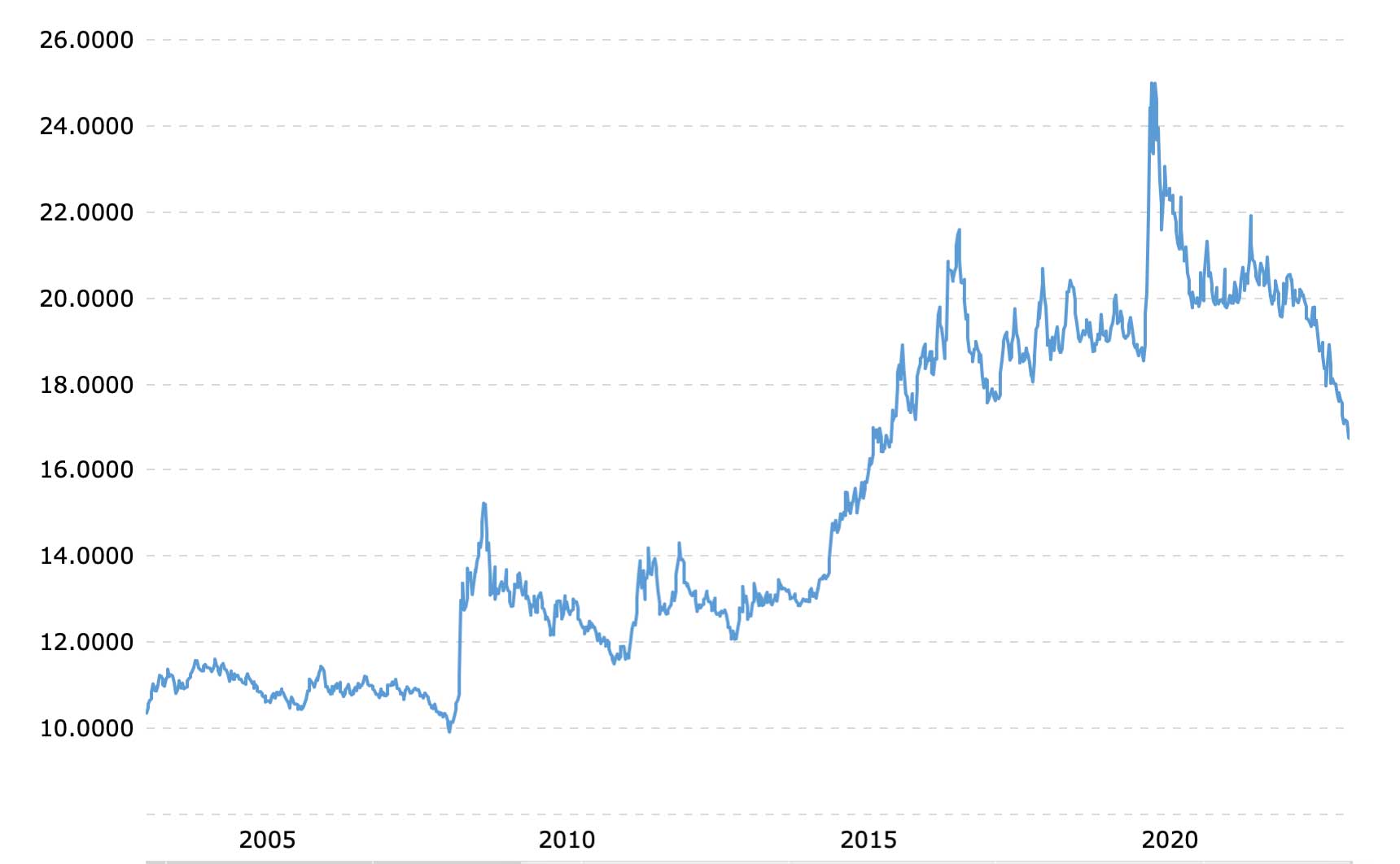

An interesting trend currently taking place is with regards to the strong value of the Mexican peso against the US dollar. At the end of March in 2020 the rate reached a high of nearly 25 pesos to the US dollar. Since then, for more than two years now, the peso has continued to appreciate in value, so that as of July of this year the exchange rate was under 17 pesos to the dollar, meaning the peso has appreciated more than 40% over the last 28 months.

This has had a profound affect on national buyers who bought into the Puerto Vallarta market primarily because real estate was priced in USD, as a way to hedge their pesos. With restrictions on USD accounts in Mexico, and increased difficulty of holding one in the US for Mexican Nationals, Vallarta's real estate became a safe haven for them. For years this worked very well for national buyers. As an example, for someone who bought a property in Vallarta in pesos in 2010 would have seen the value of their property double in ten years, just because of the change rate, and the fact that real estate in Vallarta is sold in USD. However, for someone who may have bought a property in 2020 for US$100,000 but paid in pesos ($2.5 million pesos), if they sold it today for the same price in US dollars, they would receive back only $1.7 million pesos - a considerable drop in value. Fortunately, however, prices have appreciated over this time period, hopefully enough so that national buyers could recoup their original investment.

For American sellers, since the Mexican land registry registers properties in pesos, this has recently been an unforeseen gain for them. If they'd bought a property in 2020 for US$100,000, it would have been registered at $2.5 million pesos. But if they sold it today for US$150,000, realizing a US$50,000 gain, the sale would be registered in pesos at today's exchange rate, which would be $2.55 million pesos, meaning it would show a gain of only $50,000 pesos. Long story short, they'd walk away with a US$50,000 gain and have paid little-to-nothing in capital gains taxes.

For many years this worked against American buyers. In some cases, they could end up having to pay capital gains taxes when they actually didn't see a gain in USD terms. But today, at least over the past couple of years, the table has been turned around.

The US dollar is viewed internationally as a safe haven as it can protect asset values in times of recessions and market downturns. In the chart above you can see two times when the Mexican peso lost value quickly over the past 20 years; once during the 2007-2008 financial crisis and again during the Covid pandemic, which resulted in a recession, in 2020. So in times of trouble the Mexican peso has traditionally lost value extremely quickly. Since 2020 the markets have been relatively calm with stock markets seeing a slow rise in value. It will be interesting to see how the peso will react when there is the next (inevitible) market downturn.

Similar posts