by John Youden - June 23, 2019

A recent article in the New York Times entitled As Markets Waver, the Rich Park Money in Luxury Homes, suggests that there is an increasing interest by affluent Americans for a second (vacation) home, and for many that may mean outside of the United States. Mexico has traditionally been a favorite destination for both Americans and Canadians, because of its close locality to major city and markets, and for many other good reasons as well.

NYT staff writer Kerry Hannon states that, “While owning residential real estate is typically part of a diversified investment portfolio, what is different in the last year or two is the role the uncertain economy is playing in making purchasing decisions. Many high-net-worth investors are plunking cash in a second or third high-end residence as a safety net, stemming from concern about a wide range of economic and political factors. These include the possibility of rising interest rates in the United States, China’s slowdown, low oil prices, conflicts in the Middle East and the reality that equities have been lethargic and bonds have floundered in a bear market. People with money are keen to diversify it beyond the U.S. stock market in particular. A vacation or second or third home in a sunny Shangri-La is an increasingly appealing option. It’s a hard asset that doubles as a lifestyle enhancement and that cushions the buyer from any shocks U.S. markets may be in for.”

U.S. stock markets are at all-time highs, so many may be seeing this as an opportunity to take out some of their gains and further diversify their portfolio, while also obtaining they can use and enjoy with their families.

Hannon continues, “While most ultra-high-net-worth individuals opt for a second or third home in the country where they reside, an increasing number of people with net assets of more than $30 million are buying homes in other countries, according to a 2015 report by Wealth-X and Sotheby’s International Realty. International homes account for 16 percent of non-primary ultra-high-net-worth residences, compared with 11 percent in 2010. The middle-market buyers are spending $250,000 to $500,000 on single properties, but high-net-worth individuals are spending $1 million or more in many markets…”

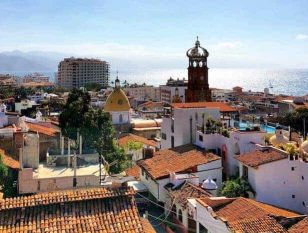

These are market price ranges where Puerto Vallarta and Riviera Nayarit currently show significant value. The $250,000 - $350,000 price range has the most activity in recent years, and the current inventory offers plenty of options with city, golf, marina, hillside or beach locations. For the over $1 million market Punta Mita and the north shore of Banderas Bay has recently seen a significant upturn in activity and realtors and agents, from the leads they are receiving, are predicting that it will certainly continue into the upcoming high season.

Similar posts