by John Youden - November 14, 2019

2024 Vallarta/Nayarit Real Estate Market in 8 Charts

by David Moreno - February 19, 2025

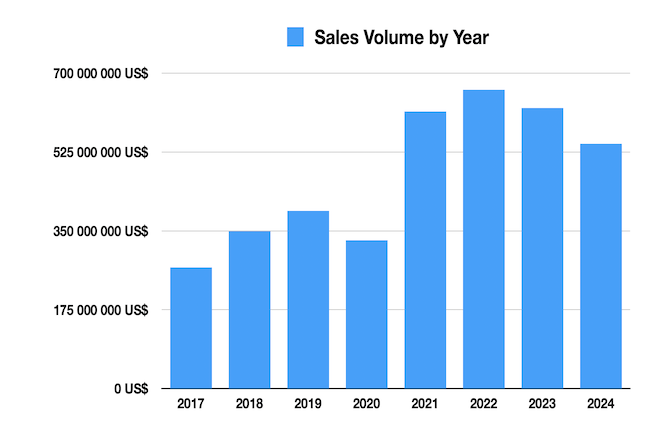

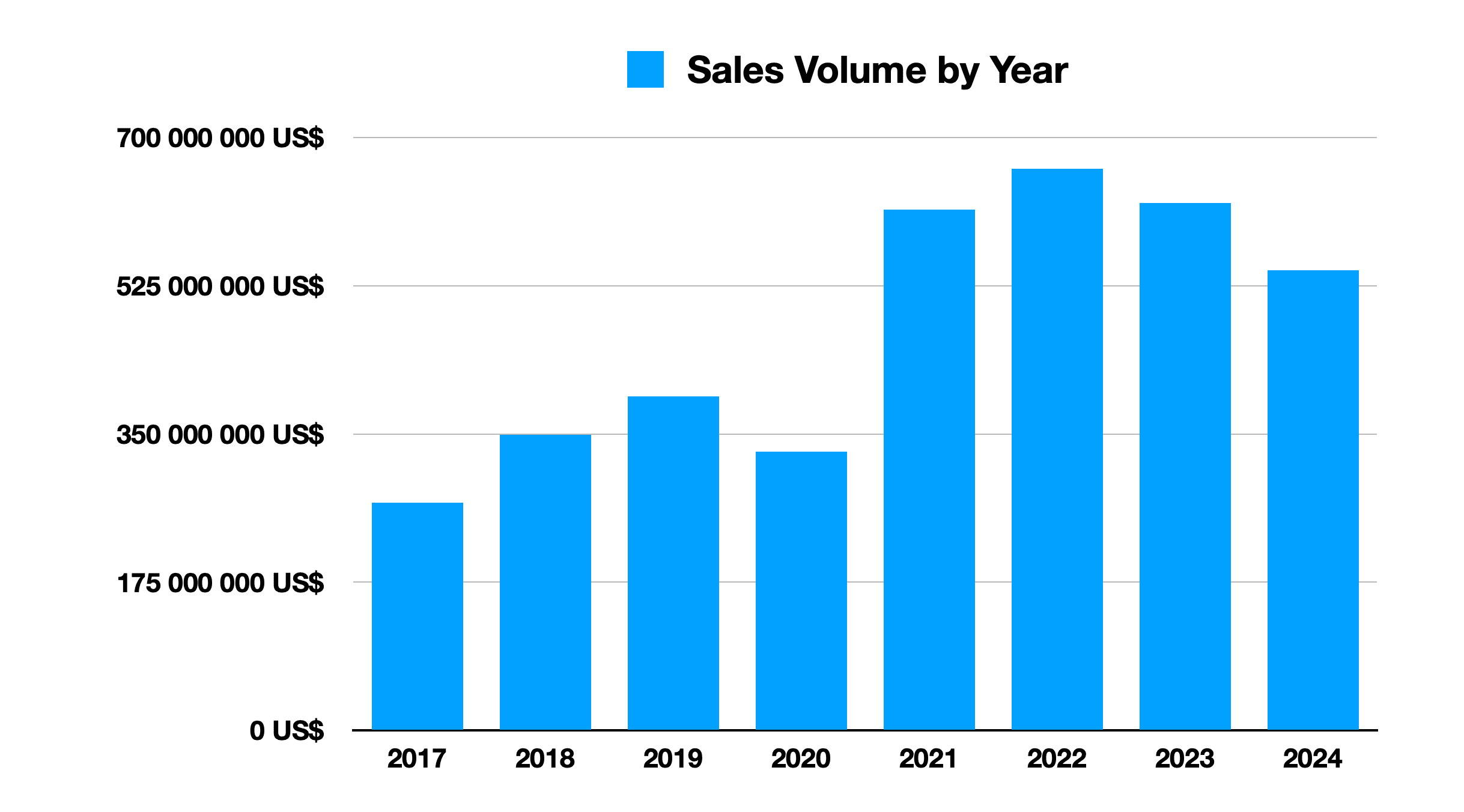

At the beginning of every new year we take a look back at the real estate market for the Puerto Vallarta/Riviera Nayarit region and compare it to what transpired in previous years, attempting to identify underlying trends. The first trend identified this past year is that the number of sales and volume were down for the third consecutive year. Does this mean a potential softening in the market? Not necessarily.

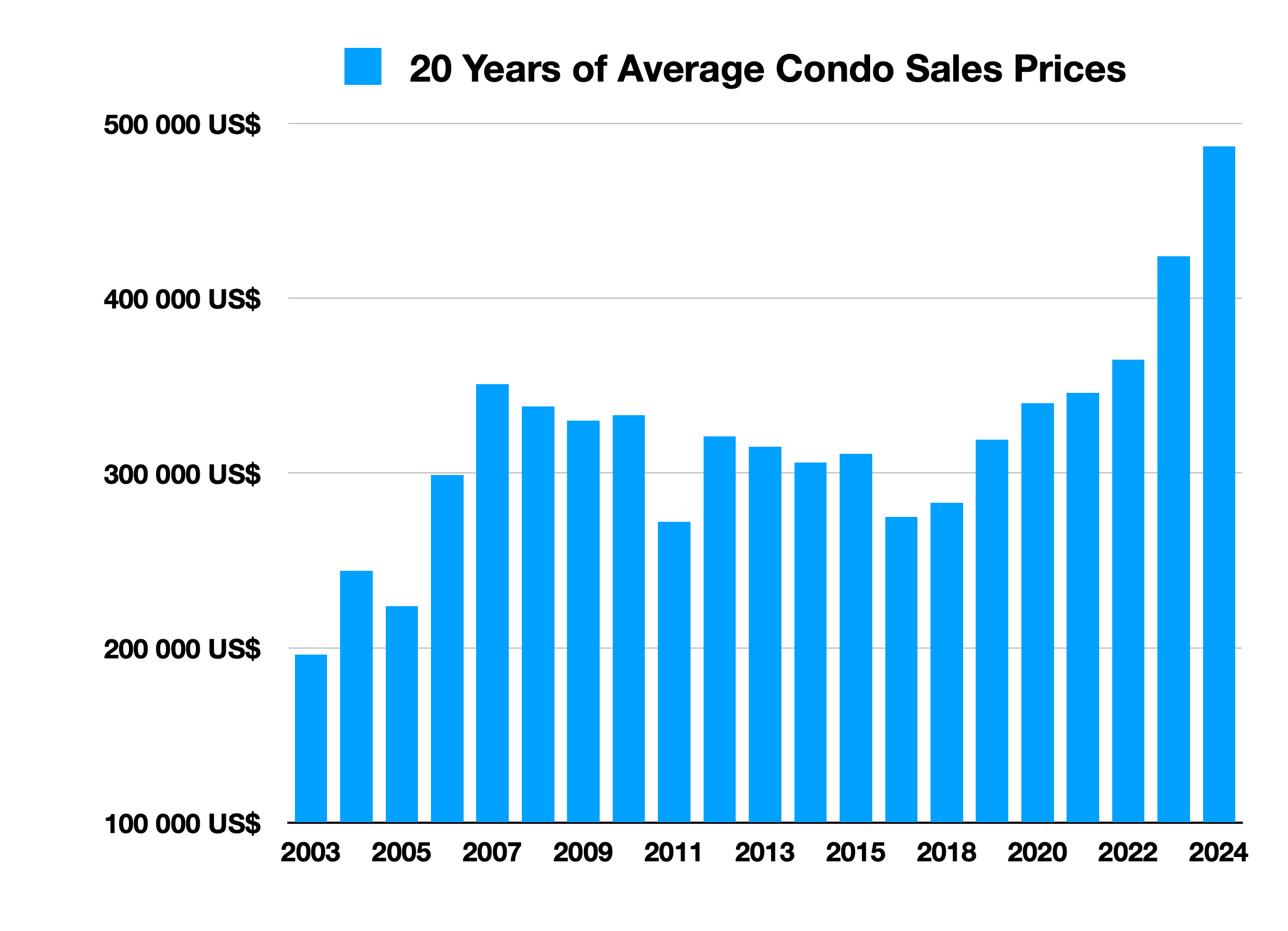

From the chart above it could be construed that the market is actually still in correction mode after the Covid-induced downturn. Sales activity was down in 2020, but then recovered dramatically, peaking in 2022, as shown in the chart below. This three-year drop seems to have just brought market activity back in line with a more normal trend line.

It should be taken into consideration as well that in every US election year the Vallarta/Nayarit real estate market usually experiences a drop in sales activity as prospective buyers wait to see what the results of the election are before making a purchase.

SALR (Sales-to-Active Listings Ratio), can be calculated to see just how healthy (or unhealthy), a real estate market may be. A balanced market is usually about 20% - or showing roughly 5 listings on the market for every sale that has taken place during the year. Anything above that is perceived as a seller’s market while below that is a buyer’s market. In 2023 it was 33% for the Vallarta/Nayarit region, implying we are still within a seller’s market.

The number of sales, however, dropped even more dramatically than volume, (volume was held up by appreciating real estate prices), matching the number of sales that took place back in 2018 and 2019. This could be a concern.

Another concern is that half of the current inventory is pre-construction - new product that is currently under construction. And there’s even more in the planning stages. Is the market being over built? Right now this isn’t a red flag but certainly something to watch moving forward.

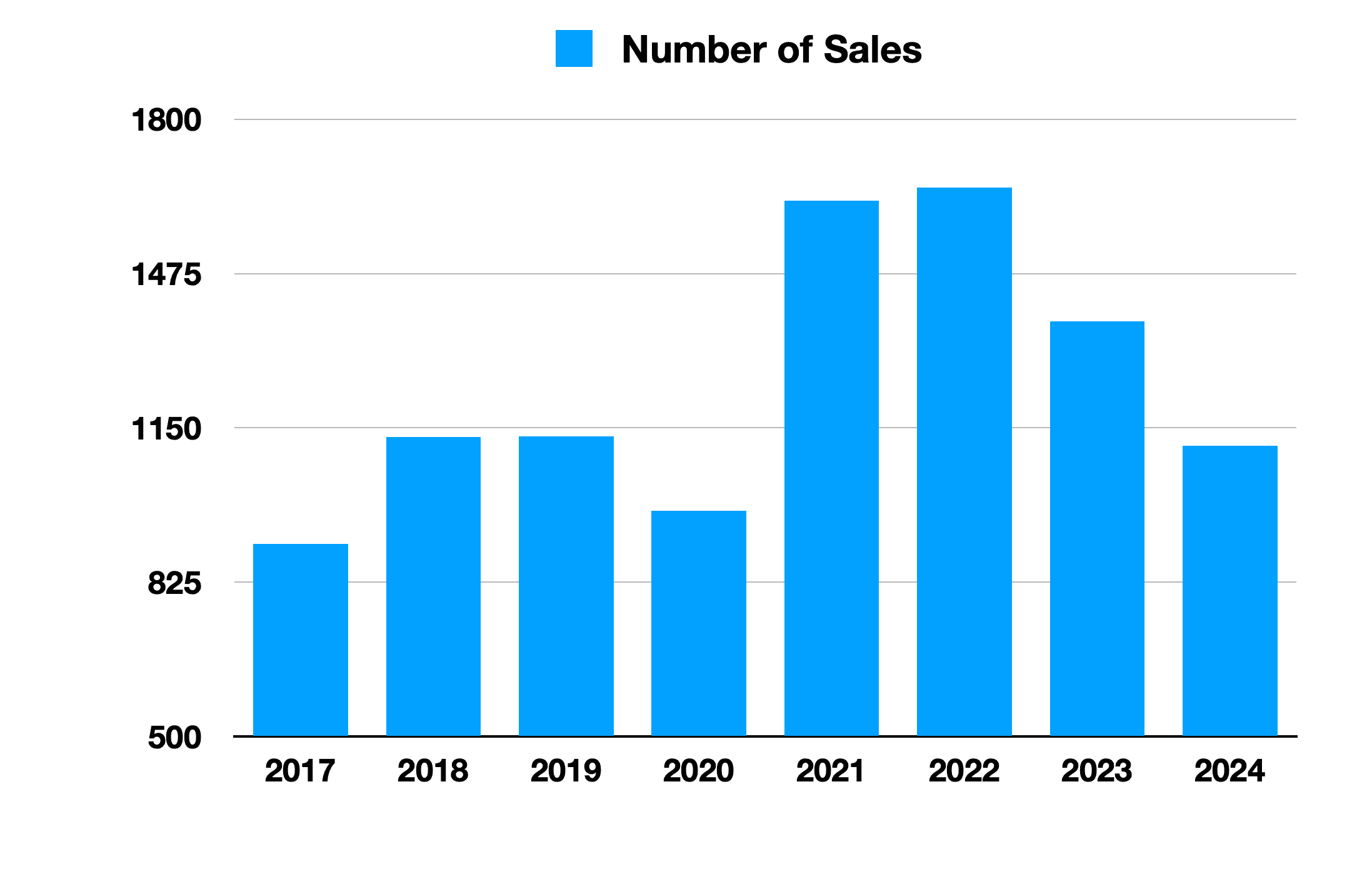

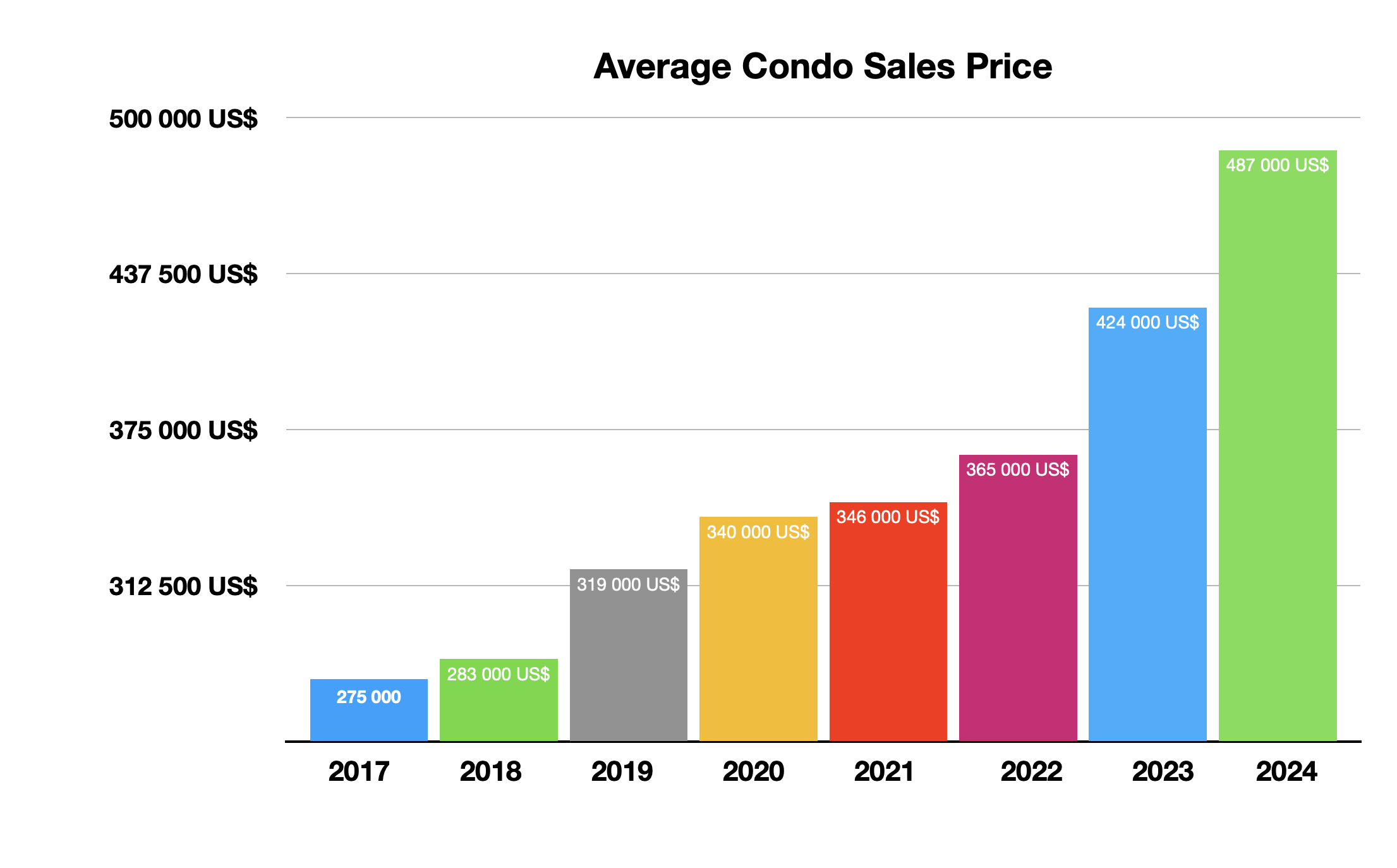

For the first time in eight years the list/price ratio increased (the average difference between what a property was listed for and what it eventually sold for), ending a seven-year downward trend. For example, in 2017 the average condominium was listed for $304,000 but eventually sold for $275,000 (9.5% less than the asking price). It was a buyer’s market meaning buyer’s could ask quite a bit below asking price. In 2023, however, the average condominium was listed for $444,000 and sold, on average, for $424,000 (4.5% less than the asking price - a seller’s market). That spread was nearly 6% in 2024. This could imply a potential shift from a seller’s to a buyer’s market. Again, it’s something to continue to watch.

And although the volume and number-of-sales have dropped over the past three years, prices certainly haven’t. The average condominium sales price is up 43% since 2020 and has been trending upwards every year since 2016.

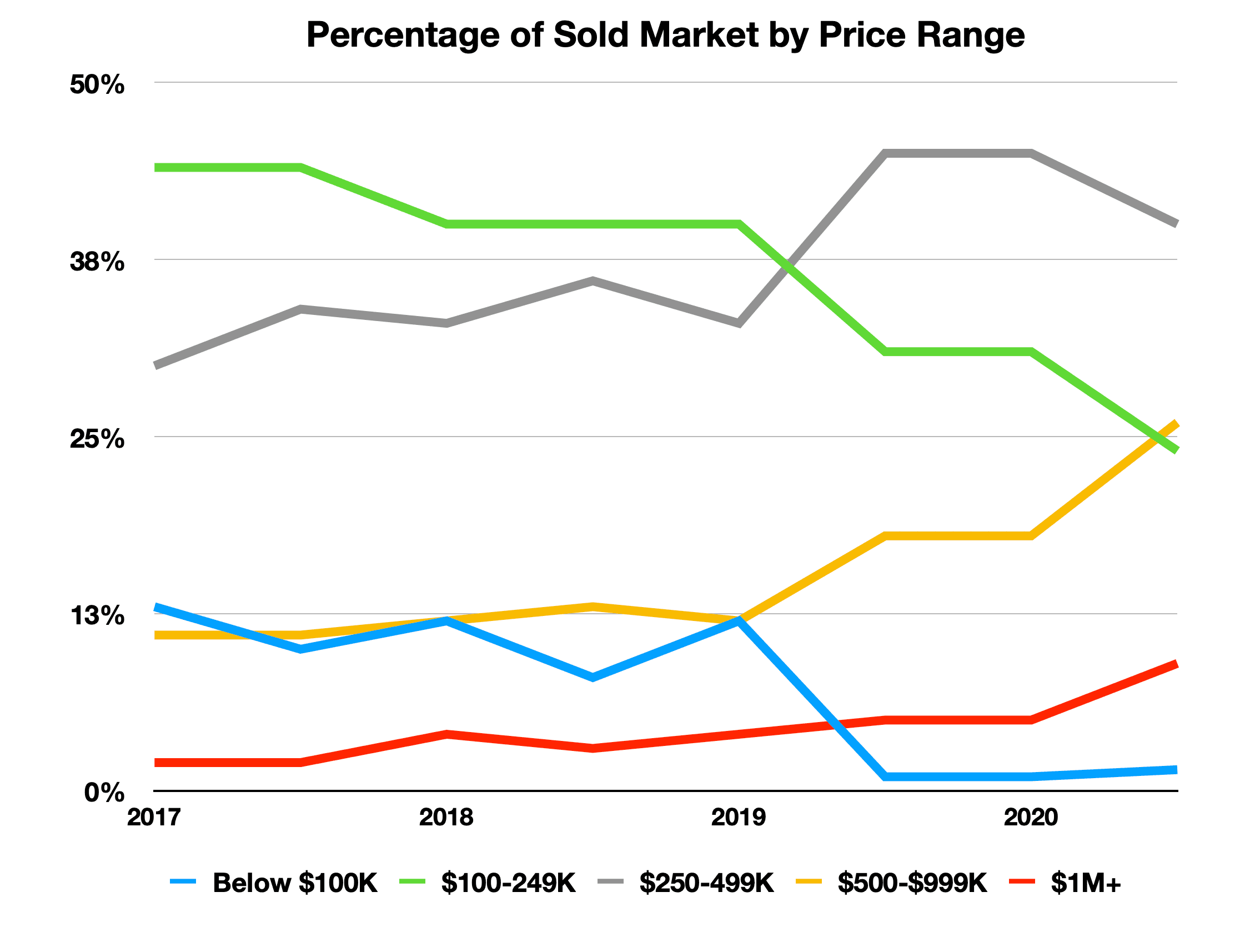

This increase is reflected in the chart below which shows how the market was sold by price range. In 2017, for instance, 44% of the sales in the Puerto Vallarta/Riviera Nayarit market were between $100,000-$250,000. In 2024 this price range encompassed only 24% of market share. The largest increase was the demand for properties between $500,000-$1 Million. In 2017 this price range made up only 11% of all sales while in 2024 it increased to 26%. Properties over $1 million are also making up a larger and larger part of the overall market.

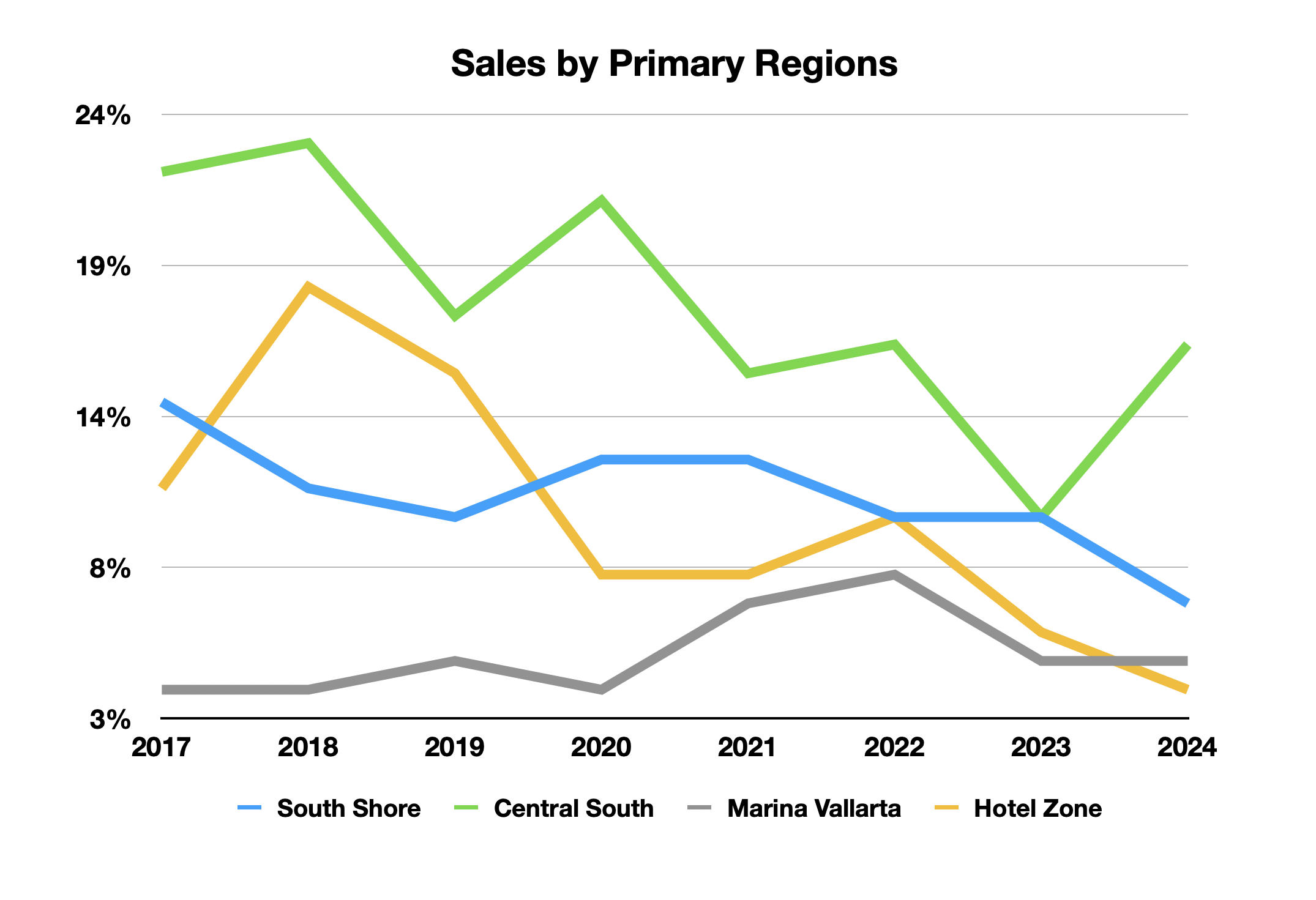

The chart below shows a trend that has been occurring for some time now - the market is expanding geographically, driven primarily by homebuyers seeking lower-priced housing. In 2017 Central Vallarta South was the most popular area for real estate purchases, responsible for 23% of all sales. In 2024, even though there was a large upswing in sales it was still down to encompassing just 16% of all sales in the Vallarta/Nayarit market. The Hotel Zone dropped even more precipitously from 18% in 2017 to just 4% of the market in 2024.

Primary Regions are those areas that have traditionally been the most popular for Vallarta/Nayarit homebuyers. They tend to be situated along the coastline of Banderas Bay and consist of the South Shore, Central North & South, Marina Vallarta, Hotel Zone, Nuevo Vallarta and Bucerias). This group encompassed 85% of overall market share in 2017. In 2024, however, their share was down to 73%. And the main reason for that was price, as was demonstrated in the previous chart.

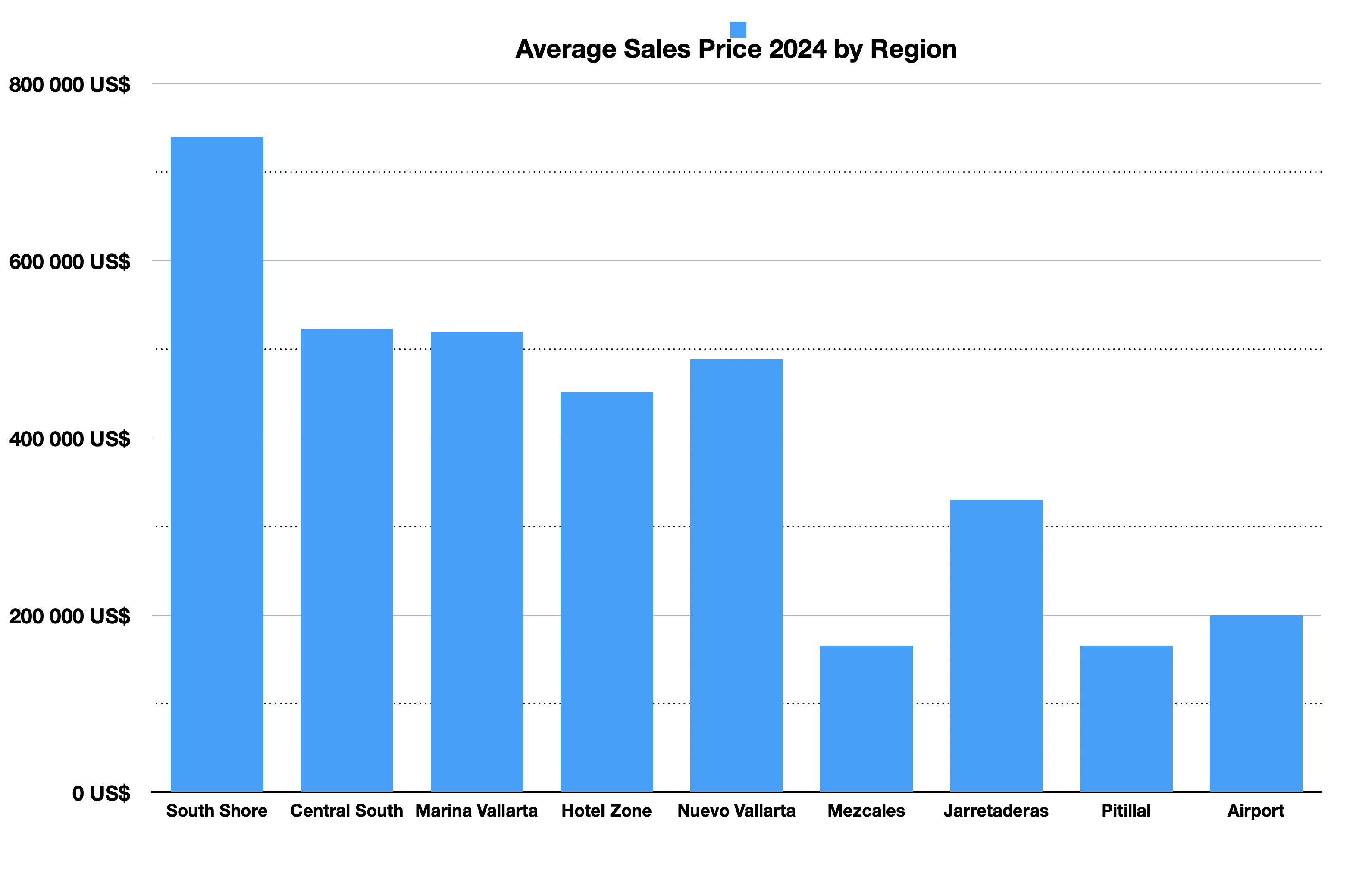

Homebuyers looking for lower prices have been forced to turn away from the traditional market areas and seek new ones. In 2024 the average sales price for a property in the Primary Regions was $550,000 while in new markets, (mainly Pitillal, Francisco Villa, Versalles, Jarretaderas, Aramara and Mezcales), the average price was $250,000 - less than half. That is a substantial difference.

Homebuyers seeking lower prices are looking outside of the downtown and coastal areas. These new markets in 2017 reported on average less than three sales for the whole year. While in 2024 most had around 20 sales with Mezcales reporting 46. Not big amounts, but each year they are increasing while decreasing in the primary regions. The graph above shows the price differences between the Primary Regions (first five) and the new popular regions.

The Puerto Vallarta/Riviera Market is expanding geographically in order to still provide real estate options in the $200,000-$300,000 price range. This transition/trend has been going on for some time. In the past, however, the trend had been for homebuyers to widen their search northwards into Nayarit in places such as Bucerias and La Cruz. But even Bucerias has seen substantial sales price increases - last year the average sales price was nearly $500,000. So where buyers were willing to overlook the farther distances from the airport and downtown Vallarta because of lower real estate prices, that is no longer the case. So developers have started building in behind Vallarta, behind the Hotel Zone and up into the valley, in areas such Versalles and Pitillal. They may be farther from the beach but are very close to major shopping centers and centrally located between Vallarta and the airport. And the price is right.

Similar posts