by MLS Vallarta - April 5, 2016

Vallarta/Nayarit Real Estate Markets Still on Fire

2018 was a record year in real estate for the Vallarta/Nayarit region, bettering 2017 by 30% in gross volume of sales. And although the market slowed down somewhat 2019, it still showed an impressive increase over 2018 by 13%, reaching US$400 million. What made up for this increase? Well, it wasn’t in the number of sales as agencies sold just as many properties this year as they did in 2018. It was because property prices increased substantially over previous years. And the difference between asking and selling price continues to tighten. It was 10.5% in 2017, 8% in 2018 and 7.5% last year.

These numbers are provided by MLSVallarta and Riviera Partners Realty who provided the numbers for the MLS system of the local real estate association, (AMPI), which together provide a reasonable assessment of the local real estate market. “Reasonable” as it doesn’t include all sales - a few of real estate developments are not members of either service and therefore their sales are not included. And it seems the farther you get away from the center of Puerto Vallarta, further up the coast of Nayarit, the less sales are reported. That said, it is commendable that certainly most sales are now reported and this is in thanks primarily to the efforts of the local real estate associations and their members (AMPI).

The market continues to be driven by American buyers (40%) although the number of national buyers has increased over they years (30%) with Canadians primarily making up the remaining 20%. A couple of reasons for the increase in national buyers is the increasing difficulty obtaining visas into the United States for Mexicans, but also because real estate in Puerto Vallarta is priced in US dollars and therefore becomes an interesting way to hedge the peso against the dollar, especially in recent years where the peso has been losing value to the US dollar.

Condominium Sales

The average condominium sales price increased in 2019 by 13%, from $282,000 in 2018 to $320,000 in 2019. The average size of a sold condominium increased slightly over 2018, from 1,415 f2 to 1,552 f2, remaining pretty much within the range it has been, on average, for more than twenty years. After the 2007 market crash, developers begin building smaller units in order to lower prices and reducing size was an easy way to do that. But they are now back up to their historical average.

For the first time in quite some time, the number of condominiums sold decreased compared to the previous year. 7% fewer condominiums were sold in 2019 than in 2018. This was made up for, however by an increase in the number of homes sold.

We went back and looked at the average sales price and size of condominiums in 2007, at the top of the market, and found that condos were selling substantially higher with an average sales price of $401,000 and an average size of 2,000 f2. But the market back then was driven by new construction and developers were building for buyers that had money to spend to get something special with extra amenities and that were larger in size. It’s probably a good sign that the current market isn’t back to those numbers.

We also took a look at what kind of condominiums were being sold, how many bedrooms they had. Historically, the two-bedroom condo has made up about half the market. It’s the same today as it was back in 2007, and the same for units with three or more bedrooms, which make up about 20% of the market. The remaining 30% was then and is today, made up of studios and one-bedroom units. But back in 2007 less than 1% of sales were studio units, compared to nearly 6% of sales in 2019. People are willing to take less to keep the price down and developers have accommodated by removing the bedroom.

Home Sales

Homes sales surged last year, increasing by more than 20% over the previous year. In 2018 the average sales price was just under $400,000 whereas in 2019 it dropped to $370,000, and for an interesting reason. The MLS systems saw an increase in the number of moderately priced townhouses coming on the market in neighborhoods not traditionally viewed as popular. One area is around the airport, which in 2007 saw no sales at all, only 4 in 2018, but over 50 in 2019. These semi-detached homes sold on average for around $100,000 and this drove down the average home sales price. If we remove these sales we find that the average home actually increased substantially in price to $425,000. These properties were primarily purchased by locals, and we are most likely going to see this trend continue as more and more local sales are reported in the MLS systems, systems that have traditionally catered more to the tourism market.

Most Popular Regions

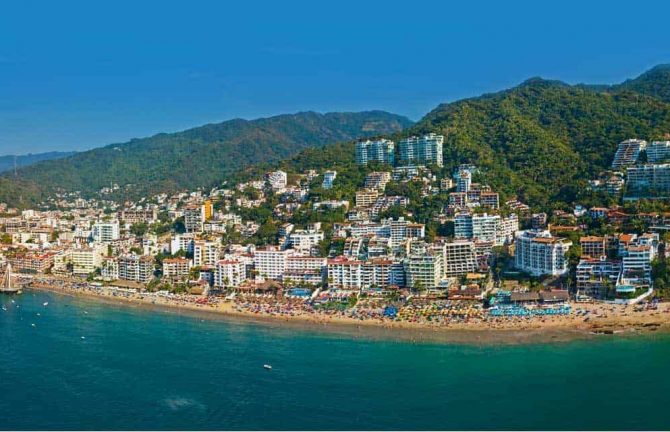

It is interesting to watch as certain regions become more popular over others over time. Back in 2007, again, at the top of the market, developers were busy building high-rises in the Hotel Zone, which accounted for almost 40% of all sales that year. Next in popularity came Marina Vallarta and Nuevo Vallarta whereas downtown Vallarta accounted for less than 6% of total sales. In 2018, however, the Romantic Zone alone, or the region south of the Rio Cuale to Amapas, accounted for 30% of all sales. In 2019 that dropped to 23%. The difference was mostly made up in a return to an interest in Marina Vallarta where a number of new projects are currently under development. The most popular region for 2019 was once again the Romantic Zone, followed by the Hotel Zone, Nuevo Vallarta, the South Shore and then Marina Vallarta.

Similar posts